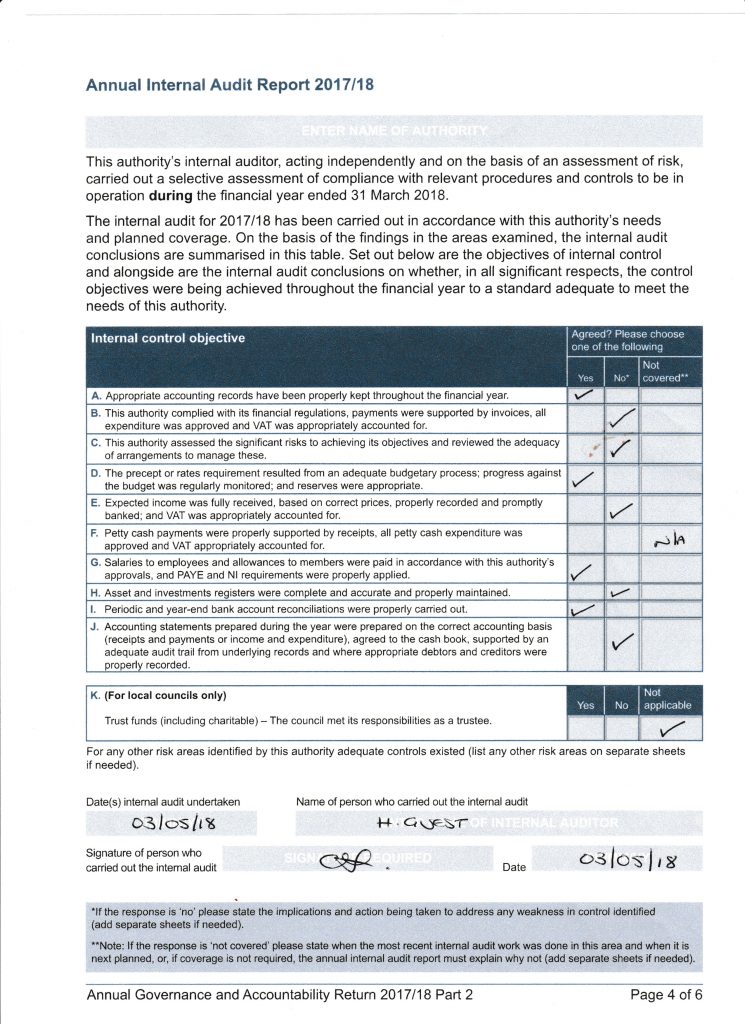

Internal Auditor’s Recommendations following

Annual Internal Audit 2017/18

- Clerk’s expenses should be separately itemised as a Parish Council expense, not as part of employment expenses.

- Council should carry out an audit of assets as soon as possible and to pass this to insurers for an accurate policy coverage.

- Clerk’s working hours/salary should be reviewed and maintained at an appropriate level –i.e. appropriate to Working Time Regulations, with overtime (a significant amount at this point) payable when accrued.

- Full review of all policies – refer to YLCA/NALC for guidance and templates.

- No requirement to itemise Clerk’s monthly salary in Agenda/Minutes as this will be evident at end of year processes and therefore Transparency Code compliant.

- Ensure correct audit trail for all receipts and payments, i.e. invoice/remittance, Agenda,

Minutes and cheque stubs correctly signed.

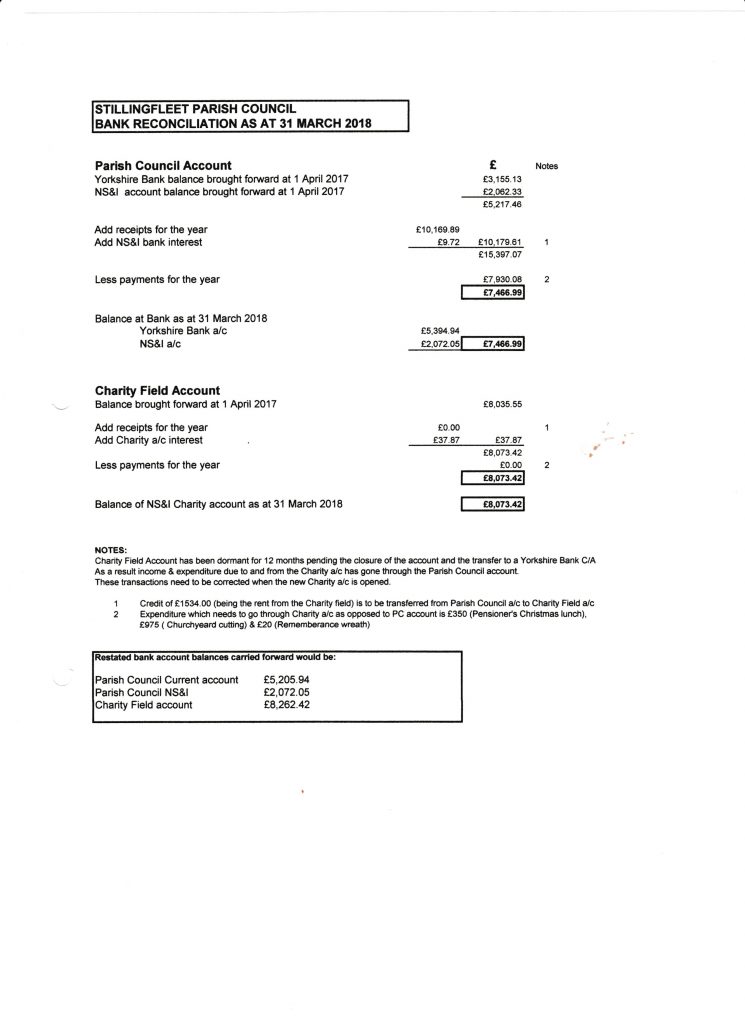

- Separate the Parish Council and Charity bank accounts to remove lack of clarity between the two.

- Agendas/Minutes – each item should be separately and individually numbered from the

beginning of the year – Clerk to adopt new numbering system immediately.

- Suggest Clerk is given delegated powers to act on behalf of the Council between meetings.

It is recommended that the above are addressed in order of priority.

I am, however, satisfied on the basis of my examination of the Parish Council accounts that the records are maintained satisfactorily in line with the Audit Commission’s current recommendations and are free from material error. Once the above recommendations are implemented and embedded in practice, I see no further matters of significant concern that need to be drawn to the Council’s attention at this point in time.

H Guest, CiLCA

3 May 2018